Table of Content

You’re guaranteed a certain amount, which you receive in full at closing. Your home’s equity is the difference between what the home is worth and what you owe for the home. If your home is valued at $300,000 and you owe $150,000, you have $150,000 in equity. Let’s say you find a sweetheart deal on a second home or investment property but don’t have the money to make the down payment or do not want to wipe out your savings account. If you have enough equity in your primary residence, consider taking out a home equity loan. So if you have enough equity in your home, you may be able to pay off all high-interest debt at once.

Now based out of Los Angeles, Alix doesn't miss the New York City subway one bit. However, one major downside to consider is that if you default on the home equity loan, the lender can foreclose on your home. Before you get a loan that uses your home as collateral, make sure you have a solid repayment plan.

Don’t underestimate the importance of balancing your checking account

More critically, having a higher income or finding ways to boost that income prior to applying for a home equity loan will also improve your debt-to-income ratio. So if you only borrow $20,000 on a kitchen renovation, that's all you have to pay back, not the full $30,000. You pay this loan back in monthly installments, with interest, while continuing to make your normal payments on your original mortgage. Cash-out refinance, you refinance for more than what you owe on your mortgage. You again receive this extra money in cash that you can use however you want. With this big down payment, you may be able to get into a larger, more expensive home because your mortgage will be smaller.

You probably won’t get the entire $70,000 in equity you’ve built because of such fees as your real estate agent’s commission and some mortgage closing costs. But you’ll end up with a solid profit that you can then use for a large down payment on your next home. If you take out an interest-only or other non-amortizing mortgage, you won’t reduce your principal balance or build equity. Instead, your payments will only go toward paying your interest, property taxes and insurance. Eventually, you’ll need to pay a lump sum to pay off your loan principal balance.

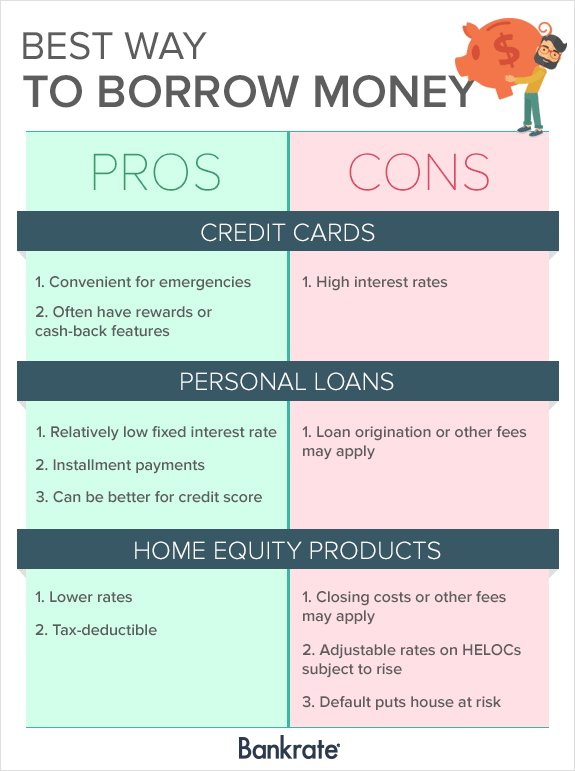

Pros and Cons of Borrowing on Home Equity

Whether youre looking to remodel your kitchen or a bathroom, using the equity in your home to pay for these upgrades is the perfect low-cost solution. Plus, quality home upgrades can help raise the value of your home even more. If your project is on the smaller side, a home improvement loan might be a better option. Marc is senior editor at CNET Money, overseeing banking and home equity coverage. He's been a financial writer and editor for more than two decades, working for The Kiplinger Washington Editors, U.S. News & World Report, Bankrate and Dow Jones. Before joining CNET Money, Wojno was Senior Editor of Finance for ZDNet, writing on blockchain, cryptocurrency, financial services, investing and taxes.

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Homeowners can use home equity to buy equipment, a security deposit for a building, or for marketing to get customers. Home improvements are one of the most common uses of a home equity loan. Home improvements can include simple enhancements such as redecorating or more substantial upgrades such as replacing a roof or building an addition. Homeowners can tap into their home equity to pay for major purchases, such as home improvements, medical expenses, a child's education, or a milestone event like a wedding. Michael Evans has written about insurance for over two decades.

Personal finance for teens can empower your child

Keep in mind that not all lenders allow for a home equity loan to be used for the down payment on a second home. A home equity loan, sometimes referred to as a second mortgage, usually allows you to borrow a lump sum against your current home equity for a fixed rate over a fixed period. Many home equity loans are used to finance large expenditures, such as home repairs or college tuition. Each lender has different programs and terms, so always check with your lender to see what they offer when you want to use your home’s equity.

Some lenders might charge closing costs, but Discover does not require borrowers to pay charges at closing. Once a loan closes, homeowners receive a lump sum cash distribution that can be used to fund renovation projects. Home equity loans are repaid in monthly installments at a fixed interest rate over a set period of time (ex. 15 or 30 years). Lenders will typically let homeowners borrow up to 90% of their equity.

The interest on a home equity loan is only tax deductible if the loan is used to buy, build, or substantially improve the home that secures the loan. Use our Rate Calculator to find the rate and monthly payment that fits your budget. While it varies by lender, Discover Home Loans offers home equity loans from $35,000-$300,000. One example where this is not a good loan use is if you know that you will take on more high-interest debt in the future. Then, you’ll make the most of consolidating your debt by using your home equity.

Further, the privacy and security policies of the linked site may differ from those practiced by the credit union. Increase the value or equity of your home with a Property Improvement Loan. Build a shed, construct a deck, pave your driveway or remodel your kitchen with a loan that fits your needs. Meet with a local investment and retirement services team member who can help you plan for a better tomorrow. Maurie Backman writes about current events affecting small businesses for The Ascent and The Motley Fool.

The interest rates for home equity loans are fixed, instead of variable, and your monthly payment is consistent, so you never have any surprises. With the Fed expected to hike rates further in 2023, keep an eye on interest rate movement. This is particularly important if you borrow with a HELOC as your monthly payments will change in concert with interest rates. Home equity loans, HELOCs, and cash-out refinances are all options that come with their own benefits.

Unlike some investments, home equity cannot be quickly converted into cash. That's because the equity calculation is based on a current market value appraisal of your property. That appraisal is no guarantee that the property would sell at that price. For well-qualified borrowers, the limit of a home equity loan is the amount that gets the borrower to a combined loan-to-value of 90% or less.

No comments:

Post a Comment