Table of Content

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. Looking to make smaller payments, but have the similar flexibility of a home equity line of credit? Borrowers are only required to pay the monthly interest due based on the balance.

Doretha Clemons, Ph.D., MBA, PMP, has been a corporate IT executive and professor for 34 years. She is an adjunct professor at Connecticut State Colleges & Universities, Maryville University, and Indiana Wesleyan University. She is a Real Estate Investor and principal at Bruised Reed Housing Real Estate Trust, and a State of Connecticut Home Improvement License holder.

How long does it take to take equity out of your house?

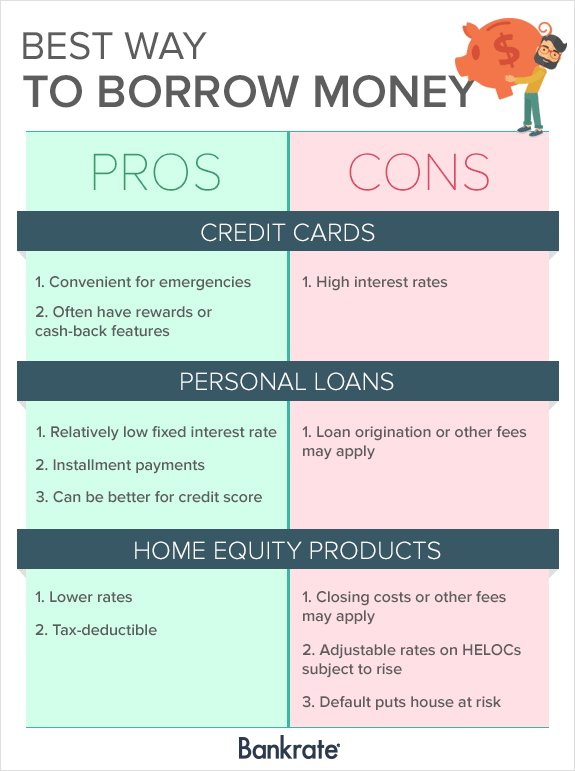

The interest rate on home equity-based borrowing is typically lower than that on credit cards and personal loans because the funds are secured by the equity. Plus, interest on such borrowing is generally tax deductible if funds are used to improve the home. Homeowners seeking money to meet their financial needs can take out a home equity loan or secure a home equity line of credit. Home equity borrowing costs are usually less than those for credit cards or personal loans. Today’s mortgage rates vary with market conditions, but the rate you’re offered also depends on the riskiness of your financial profile.

If you owe $150,000 on your mortgage loan and your home is worth $200,000, you have $50,000 of equity in your home. Every finance expert will tell you that you must have an emergency fund. This should cover three to six months’ worth of living expenses. But the harsh reality is building this fund is not possible right now.

Primary Sidebar

A TD Bank Home Equity Line of Credit may be beneficial if you want access to a revolving line of credit based on your home's equity after using your HELOC to pay off your existing mortgage. Save money on interest paid and replace multiple bills with one simple home equity loan or line of credit payment. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator. A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. The loan-to-value ratio is a lending risk assessment ratio that financial institutions and other lenders examine before approving a mortgage.

Consider using it for viable purposes if you have equity in your home. Whether you’re investing in yourself or an investment home, or you want to consolidate debt, there are many great reasons to use your home equity with a home equity loan. If you don’t want your child burdened with student loans, but they won’t get enough financial aid to cover college costs, you can use the equity in your home to cover them. Because a home equity loan is for one lump sum, make sure you know how much the home renovations will cost to ensure you have enough. Finally, if you itemize your income tax, you may be able to deduct any interest from your home equity loan if you use the money to make home improvements or renovations. A home equity loan can help you obtain the necessary capital without paying high-interest rates or jumping through hoops to get approved.

The Bankrate promise

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. There are a number of key benefits to home equity loans, including cost, but there are also drawbacks. A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt.

If your down payment is big enough, your monthly mortgage payment might be smaller than it was with the residence you sold, even if that home was smaller and less expensive. A TD Bank Home Equity Loan may be best if you plan to consolidate debt and pay off your monthly bills only once. A home equity loan is a consumer loan allowing homeowners to borrow against the equity in their home.

Ready to Buy or Refinance? Let us show you how.

See how home equity financing compares to personal loans, a cash-out mortgage refinance and credit cards. Pay for bills or needed purchases with home equity funds instead of credit cards or loans to avoid incurring higher-cost debt. For instance, use the funds to pay for college tuition and expenses instead of taking out a student loan. Make needed changes to your home without taking out a higher-rate personal loan. A cash-out refinance refers to using your equity to get a new mortgage that's larger than the amount owed on your existing mortgage. Then, you pay off the existing mortgage and use the remaining money as needed.

That also means you pay back a HELOC incrementally based on the amount you use rather than on the entire amount of the loan, like a credit card. If you find yourself unable to make the payments on your home equity loan, the lender could foreclose on your home and evict you. That will increase the value of your property, and they should only be used to finance different kinds of life expenses if other types of financing aren't available to you. CD loans are secured by your certificate of deposit account.

This strategy enables you to make predictable fixed-rate payments over a period of four to 30 years. If you’re planning on tapping into your home’s equity, it’s key to have a strategy for how you’ll use and pay back the money you borrow. So, you want to make sure you have room in your budget in case you face job or income loss. Since this is a new mortgage, you’ll typically have to pay closing costs and lock in a new interest rate.

But if you crunch your numbers carefully, you might manage to pretty accurately estimate your home improvement bill. And that way, you can borrow the amount you need initially without having to worry about that loan costing you more in the long run. Home equity loans have a fixed interest rate, while HELOC interest rates are variable. Most prospective homeowners have an inkling of what a mortgage is. In simple terms, it’s when a bank pays for the applicant’s chosen home. This is always done with the understanding that they’ll pay back the principal.

You can also use that equity to pay for major home improvements, help consolidate other debts or plan for your retirement. Your credit score will impact the loan programs and interest rates you qualify for, as well as the down payment amount that may be required to secure your loan. Buying your first home is an exciting and fulfilling experience. You’ll find that you want to improve or upgrade your house as the years go by. You can use this loan to fund your home improvement projects. Loan experts say it’s a good option since these projects can raise your home’s value.

You should figure out how costly your home remodel will be and borrow only the amount you need. But it’s important to know what these loans entail and how best to use them to pay for home remodeling. In observance of the Christmas Holiday, all MMFCU locations will be closed on Monday, December 26. Access to your accounts is available through online banking, mobile app, or ATM anytime. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. In a recent TD Bank survey, 43% of respondents who are renovating their homes or planning to renovate are using a home equity loan or HELOC for that purpose.

Webinar: Mortgage basics: Buying or renting – What’s right for you?

Rates assume a loan amount of $25,000 and a loan-to-value ratio of 80%. HELOC rates assume the interest rate during credit line initiation, after which rates can change based on market conditions. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014.

No comments:

Post a Comment